T2202 and T4A information

2025 Tuition Tax Receipts (T2202) available February 28, 2026

** T2202s will be available by February 28, 2026 covering the 2025 Tax Year from January 1, 2025 to December 31, 2025. (Note: If you are registered and attending in 2026, your T2202 will be available in 2027)

We require your Social Insurance Number for tax purposes!

Beginning with the 2019 income tax year, the T2202 (Tuition and Enrolment Certificate) now includes the student’s Social Insurance Number (SIN). This is required for income tax purposes. Cambrian College, as issuer of the T2202 form has a legislated obligation to ask for and report SINs on the T2202 forms.

If you have not provided your Social Insurance Number (SIN) to the College, you can simply do so by stopping by the Enrolment Centre during office hours or doing it yourself through your myCambrian portal.

For more information please read more about the T2202 form on the Canada Revenue Agency (CRA) website and CRA Brochure about Students and Income Tax.

What is a T2202?

The Tuition and Enrolment Certificate (T2202) allows you to reduce any income tax you may owe by claiming a tuition tax credit.

The Tuition and Enrolment Certificate (T2202) for the previous tax year will be available by the end of February. If you are attending school in the current year, T2202 forms will be available next year.

Your T2202 form can be accessed by logging into to your myCambrian portal. Under the Welcome tab, scroll down to the T2202 – Tuition and Education Amounts section. Click on the access link as displayed below:

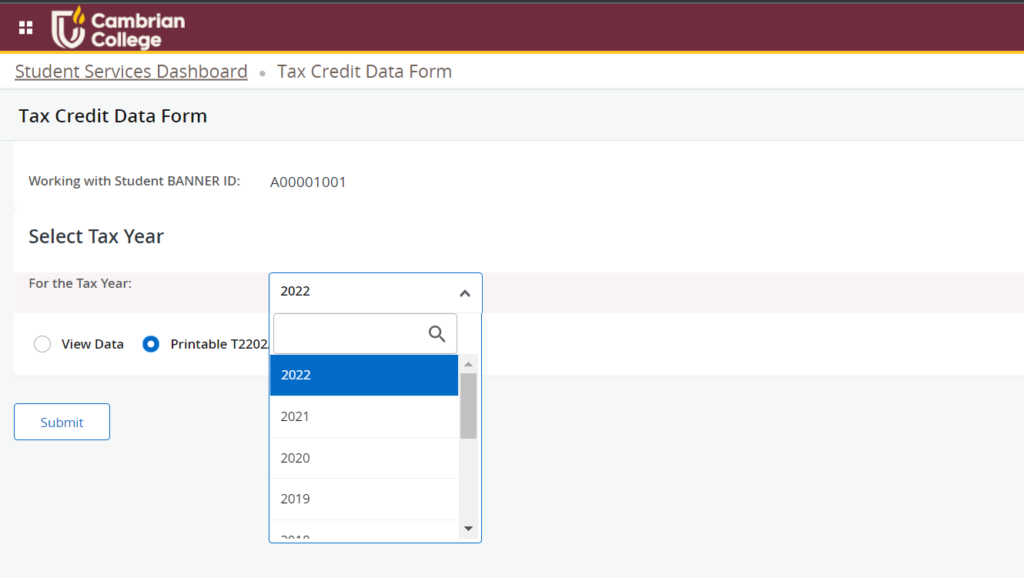

You must select the appropriate year; the tax years will display only for the years that there is actual information available as displayed below:

Please note

No certificate is produced if total eligible fees are less than $100 for the tax year. The PDF report will appear on the screen for printing.

Also, the federal education and textbook tax credits were eliminated effective January 1, 2017. You will still be able to carry forward unused education and textbook credit amounts from years prior to 2017. The tuition tax credit was not eliminated.

If you have no T2202 showing for a specific year and you think there should be or if you need any assistance, please contact the Enrolment Centre at: enrolmentcentre@cambriancollege.ca

You can make this request:

- in person at the Enrolment Centre

- by phone 705-566-8101 ext. 3003

- by email enrolmentcentre@cambriancollege.ca

- by mail Enrolment Centre, Cambrian College, 1400 Barrydowne Rd, Sudbury ON, P3A 3V8

What is a T4A?

A Statement of Pension, Retirement, Annuity, and Other Income (T4A) is provided by the College to students who have received awards, including scholarships and bursaries, in the previous tax year. These slips are mailed to students in late February each year from Cambrian College’s Accounting department.

For more information, please contact Accounting by phone at (705) 566-8101 ext. 7353 or by email at accounting@cambriancollege.ca.

OSAP T4A slips

If you are a student on OSAP, who has have received grants you will have a T4A available the following year. You can access this document through your online account with the National Student Loans Service Centre (NSLSC) account. From your online mailbox, you will be able to view, save and print your T4A slip and your Income Tax Receipt for interest paid.

For more in formation on creating a National Student Loan Centre account please click Sign up for NSLSC on-line account now.

International students

T2202 information is provided to all students to enable them to complete their Canadian tax returns. Contact a tax professional to determine whether you need to file a Canadian tax return and/or a tax return in your country of origin.

For more information please visit International students studying in Canada CRA Website.